WELCOME

Today’s

international

business

is

a

permanent

search

for

finding

an

edge,

this

mystic

advantage

over

competitor

in

global

markets.

To

be

one

step

ahead

is

a

never

ending

challenge

of

finding

the

best

innovation,

developing

technology

in

the

most

efficient

way

and

going

an

effective

way

of

financing

the

strategy

towards

international

commercialization

and

successful

business.

This

involves

to

understand

the

involved

risk

and

risk

management

to

succeed.

Business-Driven

Innovation

demonstrates

how

science

and

technology

can

be

managed

in

order

to

meet

well-defined

business

directives.

Our

website

shall

give

you

an

overview

and

further

information

on

how

we

can

support

you

in

your

challenges

towards

new

or

existing

markets

with

innovative

products

and

market

leading

services.

Innovation,

in

common

words,

is

the

process

of

translating

an

idea

or

invention

into

a

good

product

or

service

that

creates

value

for

which

customer

will

pay.

The

idea

must

be

replicable

at

an

economical

cost

and

must

satisfy

a

specific

demand.

Innovate

and

Execute

is

the

secret

of

transforming

an

innovative

idea

into

successful

business.

Besides

having

this

“greatest

and

latest

Idea”

and

maybe

a

prototype

already

in

place,

the

individual

innovation

needs

to

create

payable

value

or

it

remains

an

idea.

Therefore,

it

is

mandatory

to

transfer

an

initial

idea

into

a

business-focused

innovation

which

leads

to

business

and

revenue.

This

is

the

art

of

transferring

an

idea into a business model, finding a realistic business case and approaching markets.

“Business-Driven Innovation demonstrates how sciences and technology

can be managed to meet well-defined business directives”

Research & Development

Applied Artificial

Intelligence

EU Grants

National Grants

Innovation Management

Technical Management

Business Transition

“Road to Germany”

Cluster support

© 2022 Scaberia AS - all rights reserved -

ABOUT

Scaberia

AS

is

a

Technology

Development

and

Innovation

Management

company

based

in

Oslo,

Norway.

Scaberia

provides

R&D

support

in

the

area

of

Machine

‘Deep’

Learning

and

Artificial

Intelligence

for

the

FinTech

industry,

energy

and

industry

4.0,

but

also

support

clients

within

their

Innovation

activities

in

a

number

of

other

industries.

Scaberia

is

specialised

in

the

area

of

‘Innovation

to

Business’;

means

from

research

and

development

of

new

products

to

market

launch

and

international

marketing

of

innovations.

Scaberia

boosts

customer’s

innovative

strength,

operational

excellence,

growth

and

internationalisation.

Scaberia’s

key

personnel

earned

their

professional

experience

by

working

for

more

than

25

years,

both

in

academics

and

industry,

in

research,

new

product

development

and

innovation

management

as

well

as

in

growth

strategies,

global

business

development, and global marketing and sales strategies.

Since

2006,

Scaberia

offers

services

to

the

industry

and

public

sector

on

strategy,

technology

development,

innovation management, and global business development.

Scaberia’s

customers

comprise

entrepreneurs,

start-ups,

SMEs,

large

corporate

enterprises

and

the

public

sector

from

various

industrial

sectors

(i.e.

fintech,

cybersecurity,

telecom,

broadcasting,

maritime/offshore

transport,

eMobility,

oil

and

gas,

renewables,

and

eHealth).

Scaberia

collaborates

with

numerous

research

centres

at

regional

and

European

level

in

different

fields

of

activity

but

also

works

active

with

leading

Industry

Cluster

all

over Europe.

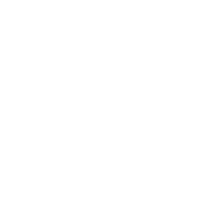

Aerospace

© 2022 Scaberia AS - all rights reserved -

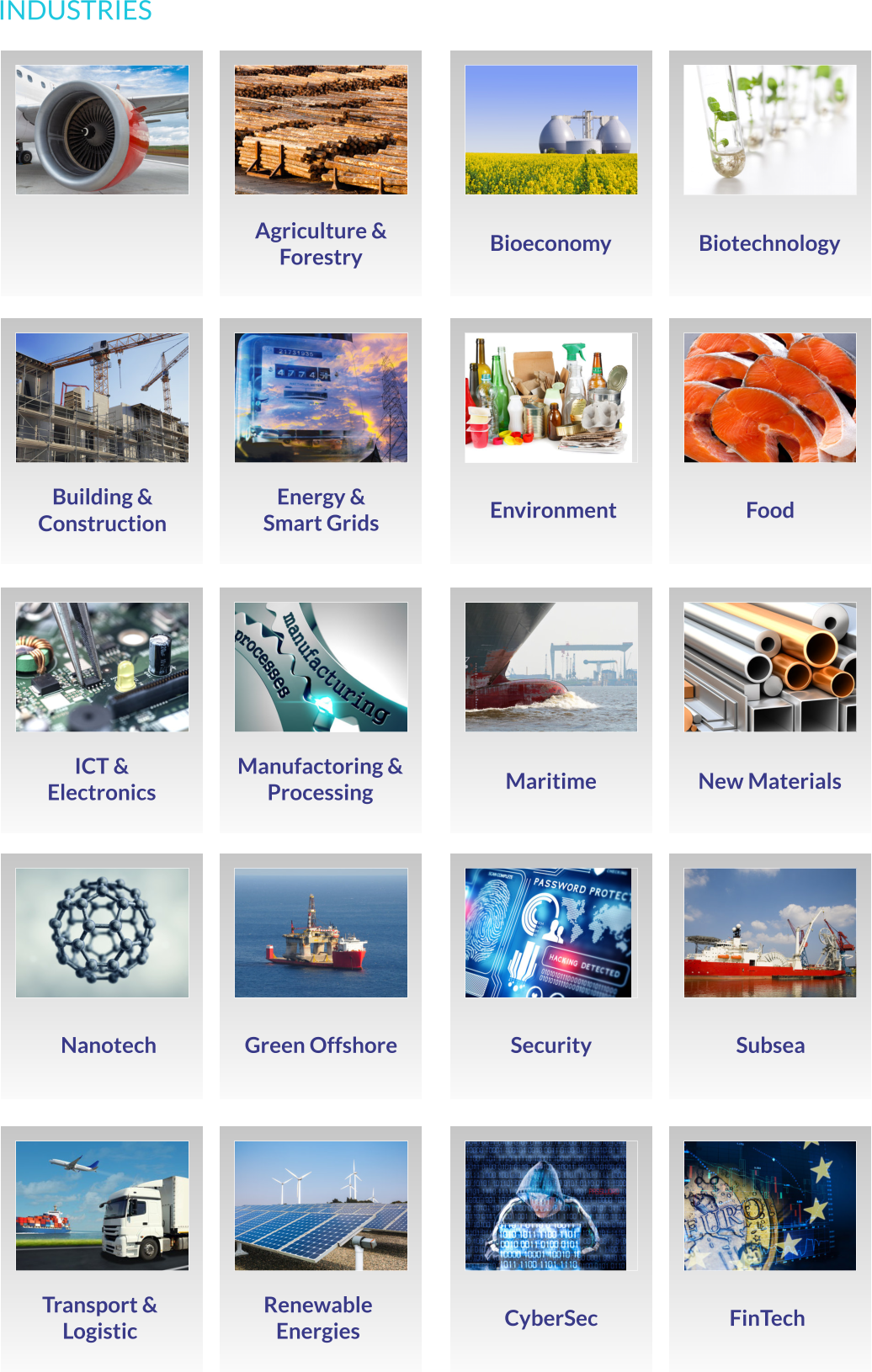

COMPETENCES

The

Scaberia

team

has

achieved

a

very

long

track

record

of

working

in

Top

Research,

Innovative

“Game

Changing”

Technologies

and

Global

Business

since

over

30

years.

The

result

is

a

proven

and

very

successful

track

record

of

project and outstanding expertise in a cross sector/industrial environment on National, European and Global Level.

© 2022 Scaberia AS - all rights reserved -

CONTACT

IMPRESSUM

Company

: Scaberia AS

Managing Director

: Frank Schmull

Org. Norway

: 919398930 MVA

Address

: Bølerskrenten 25, 0691 Oslo, Norway

Contact Email

: contact@scaberia.com

“Scaberia” and the Scaberia Eye are registered Trademarks. All rights reserved.

For any inquieries related to this website or general contact to Scaberia AS please contact :

CONTACT

IMPRESSUM

GDPR

DISCLAIMER

GDPR

- This website is fully GDPR compliant

- No individual data will be saved, stored or processed

- This website is not using Google Analytics to optimise website utilisation

- Responsible person for GDPR can be found under IMPRESSUM

Scaberia

AS

provides

the

www.scaberia.com

website

as

a

service

to

the

public

and

website

owners

under

the

legislation

of

Norway.

Scaberia

AS

is

not

responsible

for,

and

expressly

disclaims

all

liability

for,

damages

of

any

kind

arising

out

of

use,

reference

to,

or

reliance

on

any

information

contained

within

the

site.

While

the

information

contained

within

the

site

is

periodically

updated,

no

guarantee

is

given

that the information provided in this website is correct, complete and updated.

With the usage of the Scaberia Website yoy agree to the Terms and Conditions.

Although

the

Scaberia

AS

website

may

include

links

providing

direct

access

to

other

Internet

resources,

including

Web

sites,

Scaberia

AS

is

not

responsible

for

the

accuracy

or

content

of

information

contained

in

these

sites.

The

licenses

to

all

photos

used

on

this

website

are

legally

acquired

and

any

copy

or

download

is

forbidden.

List

of

Photographers

and

Fotolia

Order

Numbers

we

have

used

is

below. If you do see a conflict please notice us immediately.

Links

from

Scaberia

AS

to

third-party

sites

do

not

constitute

an

endorsement

by

Scaberia

ÀS

of

the

parties

or

their

products

and

services.

The

appearance

on

the

website

of

advertisements

and

product

or

service

information

does

not

constitute

an

endorsement

by

Scaberia

AS,

and

Scaberia

AS

has

not

investigated

the

claims

made

by

any

advertiser.

Product

information

is

based

solely

on

material

received

from

suppliers.

If

you

have

questions

left

or

do

not

agree

with

the

given

terms

and

conditions

in

using

this

website,

please

contact

Scaberia

AS

under

contact@scaberia.com.

DISCLAIMER

All photos used on this website were legally licensed from Fotolia.com, photographers and

Fotolia Picture Order Number are as follows :

PHOTOLICENSE

halberg

52430002

chrupka

101765733

phonlamaiphoto

188482947

pavlodargmxnet

75022986

niroworld

85322030

jokapix

43778365

WilliamJu

72456017

xtock

65674345

JEGAS RA

127067808

Rawpixel.com

101962321

Jürgen Priewew

49602896

cacaroot

82320949

Mongkolchon

176822857

ronniechua

68229664

Christopher Boswell

64164607

Visions-AD

41117620

Tsuboya

42909365

Friedberg

8950162

krisana

194003102

airborne77

72025262

BRAD

56374560

riccardomojana

70521800

tashatuvango

79379075

Kara

79903769

Inok

79054904

Tatiana Shepeleva

72994342

canaryluc

65925121

James Thew

64117399

erikdegraf

3594624

Arsel

74832474

chungking

63980460

aetb

51586528

santiago silver

55285772

hfng

1863010

pixs:sell

74759605

sdecoret

251516828

Thaut Images

103910355

XtravaganT

116625022

slonme

210093658

MarekPhotoDesign

59125588

Web Buttons Inc

50400846

jovannig

132404171

danielschoenen

6235976

Rafal Olechowski

5

1404311

Note :

If you do see that we have forgotten something or made any other mistake, please notice us immediately so we can correct it.

We deny any liability.

© 2022 Scaberia AS - all rights reserved -

Scaberia AS

E : contact2@scaberia.com

T : Please email us due to telephon spam elsewise